The company recently secured $800,000 in funding, implemented a two-fold increase in weekly savings, achieved a twofold enhancement in operating efficiency, by successfully securing equipment financing.

The business not only received $2 million in funding but also expanded its auto inventory, resulting in a substantial $4.3 million profit, after successfully securing additional financing.

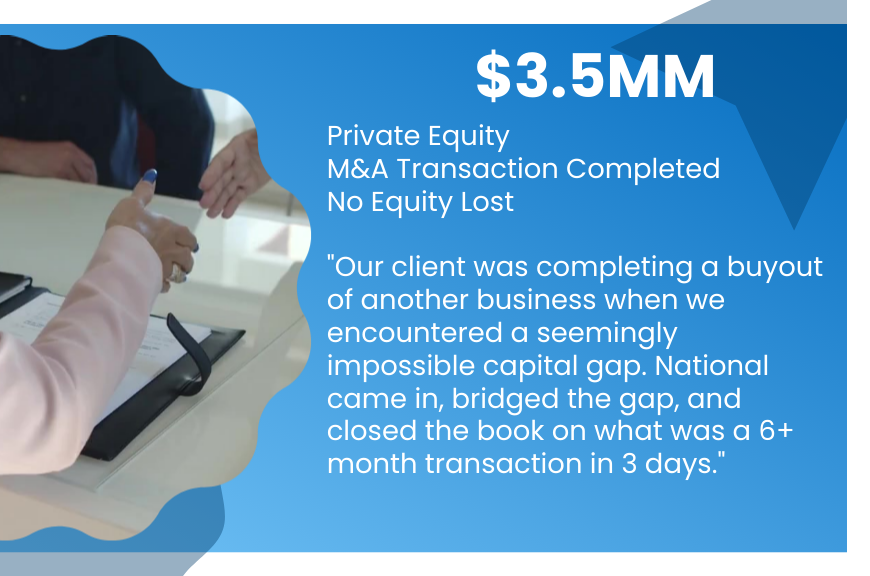

The company engaged in a private equity transaction, securing $3.5 million in gap funding, successfully completed a merger and acquisition (M&A) transaction, all while preserving its equity with no shares lost.

The eCommerce company recently secured $500,000 in funding, leveraging it to streamline cash flow, & acquisition of a business line of credit further bolstered liquidity, contributing to the overall financial health.

Having received $4.1 million in funding, the restaurant not only facilitated the creation of over 50 jobs but also achieved an impressive annual revenue between $5 million & $12 million, with subordinated debt financing.

The hospitality industry venture secured a $1 million term loan, enabling the realization of $100,000 in annual savings, and utilized the funding to renovate a bridge crucial to its operations.

This apparel manufacturer is on track to hit $8 million in sales this year, National Business Capital helped the client maintain momentum and preserve cash flow. They’re able to fulfill their inventory orders in the short term and, take another loan support their end-of-year sales goals.

After sitting on multiple large contracts from major companies, this Telecommunications received $10 million in funding, which they then grew to $22 Million to $30 Million in revenue growth.

Client owns a tree service company in Texas. Looking to purchase vehicles and equipment to build an additional team. Funding supported higher work load. Secured $300K revenue-based term loan - 7+ jobs created.

Get from application to approval in hours, contact us NOW