We are committed to being the catalyst for our clients' success, providing strategic financial support that propels them forward in their journey of growth and prosperity.

Unlock the financial support your business needs with our distinctive funding program offering a maximum amount of $10 million. Enjoy the flexibility of manageable 1 to 2-year terms, coupled with the convenience of weekly or monthly payment options. Read more.

Explore our Business Line of Credit tailored to cater to diverse industries such as Construction, Medical, Wholesale/Distribution, ECommerce, and Manufacturing. With a maximum credit line of $750,000, approval is seamlessly determined... Read more.

SBA loans offer vital financial support to businesses such as child care services, auto repair shops, and assisted living facilities. These loans come with unique benefits, including a maximum funding amount of $5 million...Read more

Discover hassle-free equipment financing tailored to your business needs. Our funding solutions cater to a variety of industries, including construction, restaurant, trucks & trailers, manufacturing, and medical. With a maximum funded amount of $5 million...Read more

Unlock your business's potential with our Advance Top Industries funding program. Whether you're in construction, medical, auto repair, retail, or the food and beverage industry, we've tailored our financial solutions to empower your growth. Our unique ...Read more

Unlock the potential of your business with our Accounts Receivable (A/R) Line of Credit, tailored to cater to the unique needs of various industries. Offering facility sizes ranging from $100,000 to $100,000,000, ...Read more

Explore our versatile inventory line of credit designed to empower businesses across diverse sectors.With facility sizes ranging from $100,000 to $10,000,000, we offer...Read More

Explore our Subordinated Debt Financing. Our funding solutions offer unique benefits, including a maximum funded amount of $10 million, flexible 1-2 year terms and approval amounts based on cash flow ...Read more

Welcome to CannaBusiness Financing, your gateway to accelerating growth in the booming cannabis industry.There are no industry restrictions, and our quick approvals, within 24 hours, guarantee funding...Read more

Discover tailored financing solutions for healthcare professionals across top industries, including doctors, dentists, nurses, and pharmacists. Enjoy low rates and extended terms, making it easier...Read more

Empower women in entrepreneurship with our Women Empowerment Loan, designed to support various industries, with a focus on the top sectors such as Food & Beverage, Retail, Medical & Healthcare, Salon & Spa, and Restaurants....Read more

With a commitment to supporting Veterans in various fields, our loans offer same-day funding, accommodating businesses of all sizes with funding ranging up to $5 million. Enjoy the freedom of choosing terms spanning from 6 to 24 months...Read more

Get from application to approval in hours, contact us NOW

The company recently secured $800,000 in funding, implemented a two-fold increase in weekly savings, achieved a twofold enhancement in operating efficiency, by successfully securing equipment financing.

The business not only received $2 million in funding but also expanded its auto inventory, resulting in a substantial $4.3 million profit, after successfully securing additional financing.

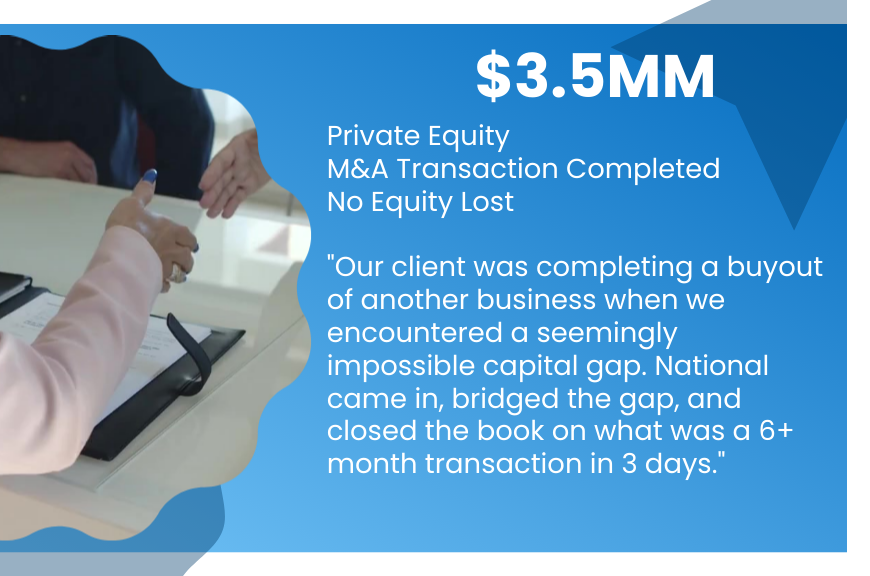

The company engaged in a private equity transaction, securing $3.5 million in gap funding, successfully completed a merger and acquisition (M&A) transaction, all while preserving its equity with no shares lost.

The eCommerce company recently secured $500,000 in funding, leveraging it to streamline cash flow, and the acquisition of a business line of credit further bolstered liquidity, contributing to the overall financial health of the business.

Having received $4.1 million in funding, the restaurant not only facilitated the creation of over 50 jobs but also achieved an impressive annual revenue ranging between $5 million and $12 million, with the support of subordinated debt financing.

The hospitality industry venture secured a $1 million term loan, enabling the realization of $100,000 in annual savings, and utilized the funding to renovate a bridge crucial to its operations.

Get from application to approval in hours, contact us NOW